How To Appeal Tax Assessment In Nj . Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. The county board of taxation. The common level range is used to test the fairness of an assessment. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. Direct appeal of property tax (only certain properties. Within 45 days of the written decision from the county board of taxation. The assessment appeal process provides a check and balance procedure in the overall assessment process.

from www.pdffiller.com

The common level range is used to test the fairness of an assessment. The county board of taxation. Direct appeal of property tax (only certain properties. Within 45 days of the written decision from the county board of taxation. Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. The assessment appeal process provides a check and balance procedure in the overall assessment process. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court.

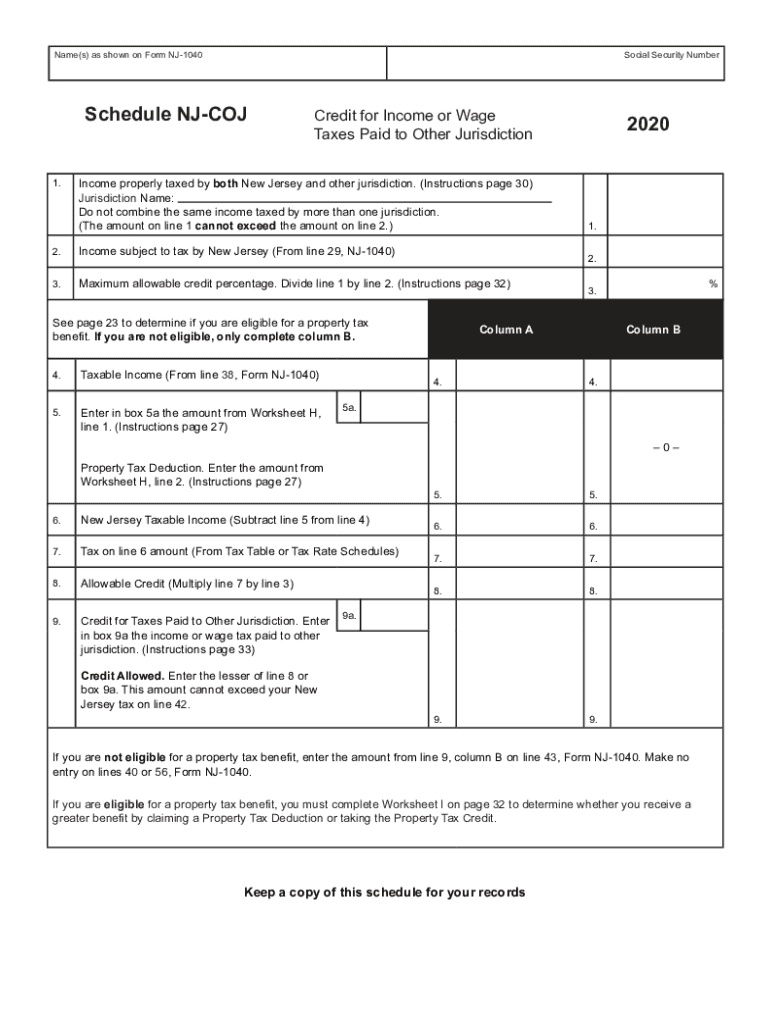

2020 Form NJ NJ1040 Schedule NJCOJ Fill Online, Printable, Fillable

How To Appeal Tax Assessment In Nj The assessment appeal process provides a check and balance procedure in the overall assessment process. Within 45 days of the written decision from the county board of taxation. The assessment appeal process provides a check and balance procedure in the overall assessment process. Direct appeal of property tax (only certain properties. The common level range is used to test the fairness of an assessment. The county board of taxation. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value.

From www.teamdamis.com

Thank you to our friends at Philadelphia Crosstown Coalition for this How To Appeal Tax Assessment In Nj Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. Within 45 days of the written decision from the county board of taxation. The county board of taxation. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the. How To Appeal Tax Assessment In Nj.

From www.doctemplates.net

Property Tax Assessment Appeal Letter Template How To Appeal Tax Assessment In Nj The county board of taxation. The assessment appeal process provides a check and balance procedure in the overall assessment process. Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. Direct appeal of property tax (only certain properties. Within 45 days of the written decision from the county board of taxation. If your property is. How To Appeal Tax Assessment In Nj.

From mavink.com

Sample Letter Of Objection To Tax Assessment How To Appeal Tax Assessment In Nj If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. Within 45 days of the written decision from the county board of taxation. Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. The. How To Appeal Tax Assessment In Nj.

From classdbschwartz.z21.web.core.windows.net

Letter Of Appeal Example How To Appeal Tax Assessment In Nj If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. The county board of taxation. Direct appeal of property tax (only certain properties. The assessment appeal process provides a check and balance procedure in the overall assessment process. Wherefore,. How To Appeal Tax Assessment In Nj.

From www.teamdamis.com

Thank you to our friends at Philadelphia Crosstown Coalition for this How To Appeal Tax Assessment In Nj If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. The assessment appeal process provides a check and balance procedure in the overall assessment process. The common level range is used to test the fairness of an assessment. Direct. How To Appeal Tax Assessment In Nj.

From assessor.elpasoco.com

Appeals Process & Notice of Valuation El Paso County Assessor How To Appeal Tax Assessment In Nj Direct appeal of property tax (only certain properties. The common level range is used to test the fairness of an assessment. The county board of taxation. The assessment appeal process provides a check and balance procedure in the overall assessment process. Within 45 days of the written decision from the county board of taxation. If your property is assessed at. How To Appeal Tax Assessment In Nj.

From www.formsbank.com

Fillable Form 130 Petition To The Property Tax Assessment Board Of How To Appeal Tax Assessment In Nj Direct appeal of property tax (only certain properties. The assessment appeal process provides a check and balance procedure in the overall assessment process. Within 45 days of the written decision from the county board of taxation. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal. How To Appeal Tax Assessment In Nj.

From www.teamdamis.com

About Greg How To Appeal Tax Assessment In Nj Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. The county board of taxation. Direct appeal of property tax (only certain properties. The. How To Appeal Tax Assessment In Nj.

From mungfali.com

Tax Appeal Letter Template How To Appeal Tax Assessment In Nj The assessment appeal process provides a check and balance procedure in the overall assessment process. Direct appeal of property tax (only certain properties. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. Wherefore, petitioner seeks judgment reducing/increasing (circle. How To Appeal Tax Assessment In Nj.

From www.saintlouisareaappraiser.com

Property Assessment How to Appeal a St. Louis County Tax Assessment How To Appeal Tax Assessment In Nj Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. The assessment appeal process provides a check and balance procedure in the overall assessment process. Within 45 days of the written decision from the county board of taxation. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000,. How To Appeal Tax Assessment In Nj.

From assessor.elpasoco.com

Appeals Process & Notice of Valuation El Paso County Assessor How To Appeal Tax Assessment In Nj If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. The county board of taxation. Direct appeal of property tax (only certain properties. Within 45 days of the written decision from the county board of taxation. Wherefore, petitioner seeks. How To Appeal Tax Assessment In Nj.

From theamericanretiree.com

State extends tax assessment appeal deadline How To Appeal Tax Assessment In Nj Within 45 days of the written decision from the county board of taxation. The common level range is used to test the fairness of an assessment. If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. The county board. How To Appeal Tax Assessment In Nj.

From www.teamdamis.com

About Greg How To Appeal Tax Assessment In Nj The county board of taxation. Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. The assessment appeal process provides a check and balance procedure in the overall assessment process. Within 45 days of the written decision from the county board of taxation. If your property is assessed at over $1 million, or the added. How To Appeal Tax Assessment In Nj.

From www.doctemplates.net

Property Tax Assessment Appeal Letter Template How To Appeal Tax Assessment In Nj Within 45 days of the written decision from the county board of taxation. Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. The common level range is used to test the fairness of an assessment. Direct appeal of property tax (only certain properties. The assessment appeal process provides a check and balance procedure in. How To Appeal Tax Assessment In Nj.

From www.youtube.com

How to Appeal Excessive Property Tax Assessments YouTube How To Appeal Tax Assessment In Nj The county board of taxation. Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. The assessment appeal process provides a check and balance procedure in the overall assessment process. The common level range is used to test the fairness of an assessment. If your property is assessed at over $1 million, or the added. How To Appeal Tax Assessment In Nj.

From www.teamdamis.com

About Greg How To Appeal Tax Assessment In Nj Direct appeal of property tax (only certain properties. Within 45 days of the written decision from the county board of taxation. The common level range is used to test the fairness of an assessment. The county board of taxation. The assessment appeal process provides a check and balance procedure in the overall assessment process. If your property is assessed at. How To Appeal Tax Assessment In Nj.

From www.teamdamis.com

Crosstown__How_to_Appeal_Tax_Assessment_Guidepage014.jpg How To Appeal Tax Assessment In Nj If your property is assessed at over $1 million, or the added or omitted assessment exceeds $750,000, you may file your property tax appeal directly with the new jersey tax court. Within 45 days of the written decision from the county board of taxation. The county board of taxation. Direct appeal of property tax (only certain properties. The assessment appeal. How To Appeal Tax Assessment In Nj.

From www.pdffiller.com

2020 Form NJ NJ1040 Schedule NJCOJ Fill Online, Printable, Fillable How To Appeal Tax Assessment In Nj Wherefore, petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value. Within 45 days of the written decision from the county board of taxation. The common level range is used to test the fairness of an assessment. The county board of taxation. Direct appeal of property tax (only certain properties. The assessment appeal process provides a. How To Appeal Tax Assessment In Nj.